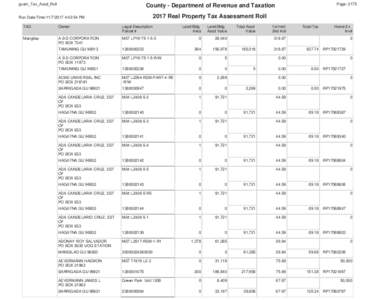

11 | Add to Reading ListSource URL: www.guamtax.comLanguage: English - Date: 2018-08-06 21:38:29

|

|---|

12 | Add to Reading ListSource URL: www.webbcad.orgLanguage: English - Date: 2018-06-08 09:13:00

|

|---|

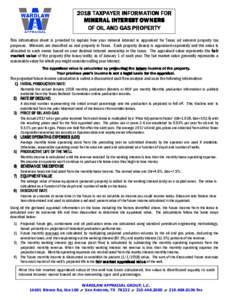

13 | Add to Reading ListSource URL: newtoncad.orgLanguage: English - Date: 2015-04-01 11:19:04

|

|---|

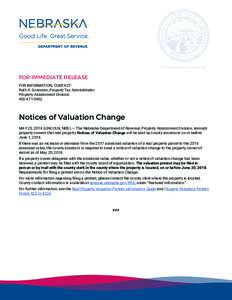

14 | Add to Reading ListSource URL: www.revenue.nebraska.govLanguage: English - Date: 2018-05-25 11:00:10

|

|---|

15 | Add to Reading ListSource URL: www.co.wichita.tx.usLanguage: English - Date: 2017-08-31 10:02:42

|

|---|

16 | Add to Reading ListSource URL: www.taylor-cad.orgLanguage: English - Date: 2017-11-07 12:07:55

|

|---|

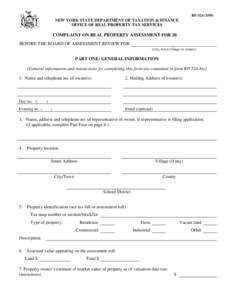

17 | Add to Reading ListSource URL: www.tax.ny.govLanguage: English - Date: 2012-04-04 14:56:54

|

|---|

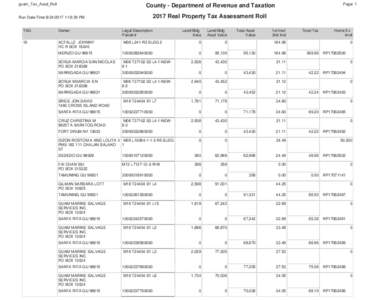

18 | Add to Reading ListSource URL: www.guamtax.comLanguage: English - Date: 2018-08-06 21:38:25

|

|---|

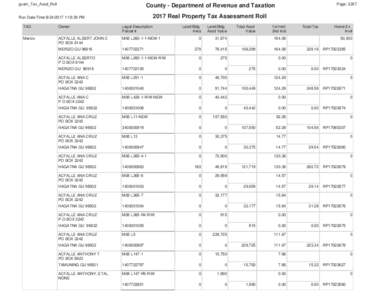

19 | Add to Reading ListSource URL: www.guamtax.comLanguage: English - Date: 2018-08-06 21:38:24

|

|---|